So every finance major you’ve ever met has learned that central tenet of the corporate religion known as shareholder theory: financial managers exist to maximize shareholder value. Simply put, a good financial manager seeks to increase their corporation’s profits and thereby grow a stock owner’s dividend payment; if the stock owner is happy, the manager is happy.

This might seem intuitive, but shareholder theory actually introduces a quagmire of moral ambiguity. Underpaying employees; exploiting child workers; and engaging in cheaper, environmentally unsustainable practices can each increase profits, but at what cost? Can any businessperson worth his salt truly justify such blatant unethicality?

Yes, actually. According to shareholder theory, we’re taught exactly that.

That’s because those employees and those children are not shareholders, but stakeholders: parties with a vested interest in a firm but who do not necessarily own stock in that firm. In this case, the stakeholders rely on the company for income–they want the company to do well so that they can make enough money to survive. In all cases, shareholder theory requires that financial managers completely cut stakeholder interests out of the picture; shady business practices of all sorts are not only allowed, but encouraged, so long as they benefit shareholders.

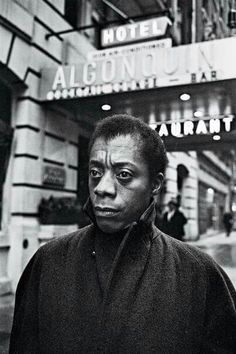

During this week’s discussions, we debated whether or not James Baldwin had a responsibility to represent the female perspective in his work as a man. Professor Kinyon reminded us that James Baldwin catered his rhetoric to a white male audience. White women historically supported the political narrative by aligning their votes with their husbands’; Baldwin could therefore concentrate his conversion efforts on an all-male congregation and achieve similar results.

To synthesize these ideas, the men are shareholders: they own stock in the political arena and Baldwin (our trusty financial manager) must appease them to succeed. The women that Baldwin marginalizes in his body of work are stakeholders and, according to shareholder theory, simply do not factor into the equation.

The funny thing about shareholder theory, though, is that–as ingrained into our curriculum as it may be–it doesn’t work. Studies show that when companies put their stakeholders first, they actually perform significantly better in the long run. By taking care of employees (factory workers, custodians, etc.), a company improves its own efficiency and reaps higher profits, therefore better satisfying both financial managers and shareholders. This is called stakeholder theory.

I believe that in the same way, Baldwin could have maximized his own success by addressing the female perspective in his work. If his goal was to increase interracial cooperation and improve the Black condition in America, Baldwin might’ve enjoyed greater success by affording women the same time and attention as men rather than ignoring 50% of the very society he sought to change. While I can understand the logic that led Baldwin to tailor his rhetoric to white men, I can’t help but question whether or not his efforts to maximize shareholder value at stakeholders’ expense precluded him from fully recognizing another value–that of the female perspective–altogether.