By: Jack Pelzer

I was recently forwarded a USA Today article from my mother (which is generally how I get news of the outside world). The piece was entitled “How much for a sandwich? Try $90,000 in lost savings”. Here’s the link:

https://www.usatoday.com/story/money/markets/2017/06/08/small-savings-add-up/102558824/

This story grabbed my attention for a number of reasons. First, as an MBA candidate, I feel it is my duty to verify the present value of future cash flows. Second, I am a connoisseur of fine sandwiches.

I needed to know whether my sandwich habit was delaying my dream retirement, which strangely enough is to eat more sandwiches. So, I fired up the old Excel and delved into the mathematical conjectures of a USA Today infographic. What follows is an overly complicated summary of my findings.

According to the article, the average American worker eats lunch out twice a week at an average cost of $11.14. Over 30 years, those paninis add up to $88,500 in forgone savings.

Right off the bat, there are problematic assumptions. Most notably, if you are writing about how small savings are a big deal, you probably shouldn’t round up your headline by $1,500 to make it look nice (I mean, c’mon, that’s a lot of sandwiches).

Also, USA Today’s sandwich math fails to account for the opportunity cost of making your own sandwiches. Let’s assume that you need $2 of home supplies to make a decent sandwich. Using the same numbers from the article, this adds up to:

$4 * 46.8 weeks = $187.20 per year for homemade sandwich supplies.

Furthermore, if we assume it takes you 5 minutes to make a sandwich, and you earn the average American wage of $24.57 per hour, then you would incur an additional opportunity cost of:

10 minutes * 46.7 weeks = 467 minutes

$24.57 / 60 = $.4095 per minute

467 * $.4095 = $191.24

After all, you could be getting to work earlier instead of making sandwiches.

Now we’re cooking. So instead of the $1,043 per year in sandwich contributions assumed initially, we are down to:

$1,043 – $187.20 – $191.24 = $664.56

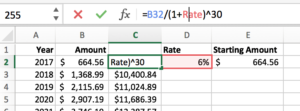

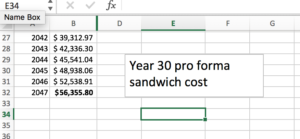

Time to open your Excel workbook. Or better yet, take my word that investing $664.56 per year at the 6% growth rate assumed by the article will equal $56,355.80 after 30 years.

But wait, that $56,355.80 is money from the year 2047. We care about money now, not money after thirty years of eating amateur sandwiches. So, let’s bring it back to the present:

$56,355.80/(1.06)^30 = $9,812.12

And there you have it. Apparently, the article is really asking, “For $9,812.12 today, would you make your own sandwiches for 30 years?”

Admittedly, this headline is less catchy and the cost is still a good chunk of change. However, I would gladly pay almost any price for a lifetime of professionally-made hoagies.

About Jack

Jack is the editor-in-chief of the MBA Irish Echoes.

Jack is the editor-in-chief of the MBA Irish Echoes.